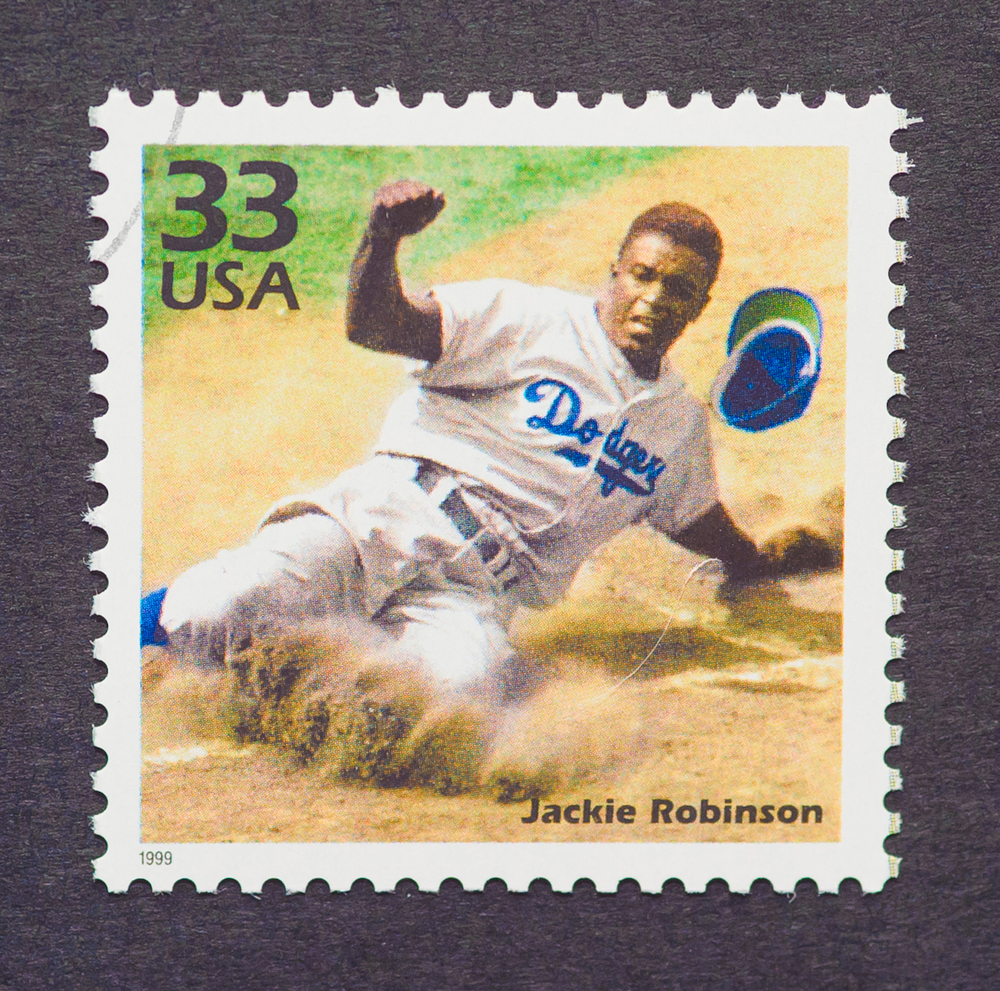

The 69th anniversary of Jackie Robinson’s breaking the color barrier in Major League Baseball is a good time to speak about collectibles as an investment and about authentication.

The 69th anniversary of Jackie Robinson’s breaking the color barrier in Major League Baseball is a good time to speak about collectibles as an investment and about authentication.

This week, Collectors Café, a company for which my company WebiMax handles the digital marketing, unveiled the original signed Jackie Robinson contracts for both the Brooklyn Dodgers and Montreal Royals. These contracts were authenticated by several experts and have been appraised at an estimated value of more than $36 million.

While collecting may be a passion for some, rare and valuable items can also yield astonishing returns, and may be a particularly good option when things get rough in the securities market. In 2010, The Wall Street Journal analyzed the past five year’s ROI of 30 of the most sought-after sport trading cards and measured that against the return of 30 companies that made up the Dow Jones Industrial Average at that time. What they found was that the cards outperformed the Dow Jones with an average return of 12.4% to the DJIA’s 7.9%.

But investors need to be careful. While securities markets may sometimes seem rife with fraud, the collectibles market can suffer similar problems, but without the same regulatory oversight.

To protect themselves, potential collectors should at least seek some kind of a guarantee of authenticity from a dealer, though it would be better to get a Certificate of Authenticity (COA) from a third party. That’s where each COA includes a hologram sticker serial number that corresponds to that authenticator’s own database. In many cases, an authenticator will be present to witness the signing of items.

The reputation of third-party authenticators is at stake for every piece on which they sign off. Some of the most reputable names in third-party authentication are James Spence Authentication or JSA and PSA/DNA. Collectors Café differs in that

the authenticity of its collectibles is underwritten by policies from seven insurance companies — Lloyds of London (HISCOX), AIG , Liberty Mutual, Chubb, CV Starr, XL, and Navigators.